When Are Property Taxes Due In Oneida County Ny . 11 by the oneida county board of legislators. Sign up online or download and mail in your application. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. The measure was passed wednesday, jan. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. It includes an $11,000 increase. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,.

from www.templateroller.com

The measure was passed wednesday, jan. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. It includes an $11,000 increase. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. 11 by the oneida county board of legislators. Sign up online or download and mail in your application. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new.

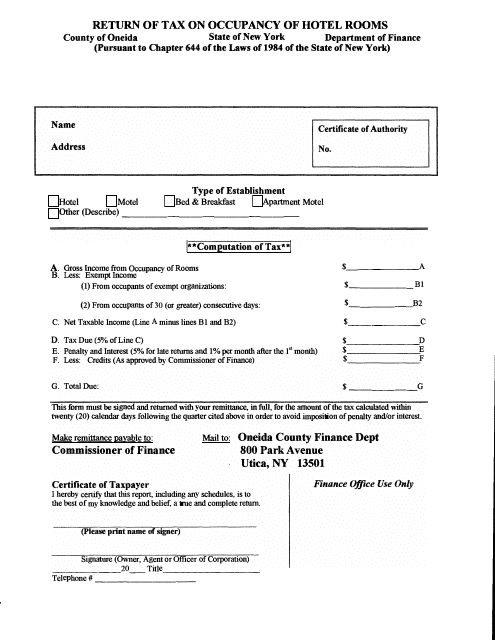

Oneida County, New York Return of Tax on Occupancy of Hotel Rooms

When Are Property Taxes Due In Oneida County Ny The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. It includes an $11,000 increase. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The measure was passed wednesday, jan. Sign up online or download and mail in your application. 11 by the oneida county board of legislators. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of.

From www.templateroller.com

Oneida County, New York Room Occupancy Tax Certificate of Registration When Are Property Taxes Due In Oneida County Ny 11 by the oneida county board of legislators. The measure was passed wednesday, jan. Sign up online or download and mail in your application. It includes an $11,000 increase. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. The median property tax (also known as real estate tax). When Are Property Taxes Due In Oneida County Ny.

From propertybook.nyc

PropertyBook Tax Maps When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The real property tax services (rpts) division of the finance department ascertains, enters. When Are Property Taxes Due In Oneida County Ny.

From tedsvintageart.com

Vintage Map of Oneida County New York, 1829 by Ted's Vintage Art When Are Property Taxes Due In Oneida County Ny The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. The measure was passed wednesday, jan. It includes an $11,000 increase. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The median property tax (also known as real estate tax). When Are Property Taxes Due In Oneida County Ny.

From news.yahoo.com

What it means to pay property taxes under protest [Video] When Are Property Taxes Due In Oneida County Ny The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. Sign up online or download and mail in your application. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The final date to pay delinquent school, village, sewer, water. When Are Property Taxes Due In Oneida County Ny.

From poweshiekcounty.org

March Property Taxes are due by March 31, 2023 Poweshiek County, Iowa When Are Property Taxes Due In Oneida County Ny The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The measure was passed wednesday, jan. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. The oneida county assessor is responsible for appraising real estate and assessing a property tax. When Are Property Taxes Due In Oneida County Ny.

From shop.old-maps.com

Oneida County New York 1840 Burr State Atlas OLD MAPS When Are Property Taxes Due In Oneida County Ny The measure was passed wednesday, jan. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. 11 by the oneida county board of legislators. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. Sign up online or download and mail. When Are Property Taxes Due In Oneida County Ny.

From www.landwatch.com

Marcy, Oneida County, NY Commercial Property, House for sale Property When Are Property Taxes Due In Oneida County Ny The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. It includes an $11,000 increase. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. Sign up online or download and mail in your application. The final date to pay. When Are Property Taxes Due In Oneida County Ny.

From www.knoe.com

Do you know when your property taxes are due? When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. Sign up online or download and mail in your application. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. The measure was. When Are Property Taxes Due In Oneida County Ny.

From oneida.nygenweb.net

Maps of Oneida County, New York When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. The measure was passed wednesday, jan. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. Sign up online or. When Are Property Taxes Due In Oneida County Ny.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. Sign up online or download and mail in your application. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The oneida county assessor is responsible for appraising real. When Are Property Taxes Due In Oneida County Ny.

From www.land.com

30.72 acres in Oneida County, New York When Are Property Taxes Due In Oneida County Ny The measure was passed wednesday, jan. Sign up online or download and mail in your application. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. It includes an $11,000 increase. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The real property. When Are Property Taxes Due In Oneida County Ny.

From www.land.com

0.11 acres in Oneida County, New York When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. Sign up online or download and mail in your application. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. The median property tax (also. When Are Property Taxes Due In Oneida County Ny.

From www.wqad.com

Property tax increase proposed to help fund Oneida library When Are Property Taxes Due In Oneida County Ny The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. It includes an $11,000 increase. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of. The real property tax services (rpts) division of the finance department ascertains, enters. When Are Property Taxes Due In Oneida County Ny.

From www.etsy.com

Oneida Reservation 1810 Map New York Old Lots Map Indian Etsy When Are Property Taxes Due In Oneida County Ny The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. Sign up online or download and mail in your application. The measure was passed wednesday, jan. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The median property tax (also. When Are Property Taxes Due In Oneida County Ny.

From hocensus.blogspot.com

Herkimer and Oneida Counties Census Data Affiliate 2014 State and When Are Property Taxes Due In Oneida County Ny The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on a median home value of.. When Are Property Taxes Due In Oneida County Ny.

From www.niche.com

K12 Schools in Oneida County, NY Niche When Are Property Taxes Due In Oneida County Ny It includes an $11,000 increase. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. 11 by the oneida county board of legislators. The measure was passed wednesday, jan. The median. When Are Property Taxes Due In Oneida County Ny.

From www.templateroller.com

Oneida County, New York Judgment of Foreclosure and Sale Fill Out When Are Property Taxes Due In Oneida County Ny The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The final date to pay delinquent school, village, sewer, water and/or sso abatement taxes is tuesday december 5,. The real property tax services (rpts) division of the finance department ascertains, enters and extends taxes levied by the board of. Sign up online. When Are Property Taxes Due In Oneida County Ny.

From www.geographicus.com

Oneida County New York. Geographicus Rare Antique Maps When Are Property Taxes Due In Oneida County Ny 11 by the oneida county board of legislators. It includes an $11,000 increase. The oneida county assessor is responsible for appraising real estate and assessing a property tax on properties located in oneida county, new. The measure was passed wednesday, jan. The median property tax (also known as real estate tax) in oneida county is $2,504.00 per year, based on. When Are Property Taxes Due In Oneida County Ny.